- Financial cyber threats in 2013. Part 1: phishing

- Financial cyber threats in 2013. Part 2: malware

Main findings

According to the information collected from the protection sub-systems of Kaspersky Lab products, 2013 saw a dramatic increase in the number of finance-related attacks, be it phishing or attacks involving malware.

Below are the main findings of the research:

PC Malware

- In 2013, of all Internet users who encountered some sort of malware attack, 6.2% encountered financial attacks involving malware. This was an increase of 1.3 percentage points compared to 2012.

- In 2013, the number of cyber attacks involving malware designed to steal financial data rose by 27.6% to reach 28,400,000. The number of users attacked by this financial-targeting malware reached 3,800,000, which is an 18.6% increase year on year.

- Among all finance-related malware, tools associated with Bitcoin demonstrated the most dynamic development. However, malware for stealing money from bank accounts, such as ZeuS, still plays the leading role.

Mobile malware

- In Kaspersky Lab’s malware sample collection, the number of malicious Android applications designed to steal financial data rose almost fivefold in the second half of 2013, from 265 samples in June to 1321 in December.

- In 2013, Kaspersky Lab’s experts first discovered Android Trojans that were capable of stealing money from the bank accounts of attacked users.

Further on in the research text, we will discuss in more detail how attacks develop over time, look at their geographical distribution, and see the lists of their targets.

Financial malware

Programs designed to steal e-money and financial data are among the most complicated types of malicious software out there today. They enable cybercriminals to quickly generate cash from their creation, so malicious users spare no effort or expense in developing financial Trojans and backdoors. Kaspersky Lab experts have noted that malware writers are even prepared to pay tens of thousands of dollars for information about new vulnerabilities – the first coder to get around a product’s security systems leaves all the criminal competition in the dust.

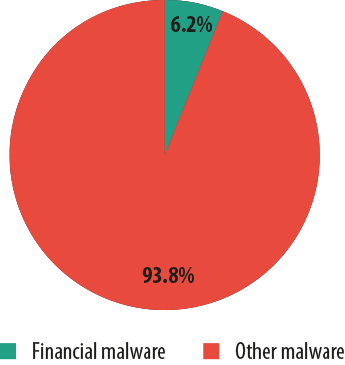

Malware designed to steal data and commit fraud was involved in a relatively small percentage of attacks (0.44% in 2013), although that is still 0.12 percentage points higher than the year before. However, when it comes to the number of affected users by financial cyber threats, the percentage is much more substantial: among the total number of users subjected to all types of malware attacks, 6.2% of those attacks involved some kind of financial threat — that’s 1.3 percentage points higher than in 2012.

Users attacked in 2013

In 2013, financial malware affected 6.2% of the total number of users targeted in malware attacks.

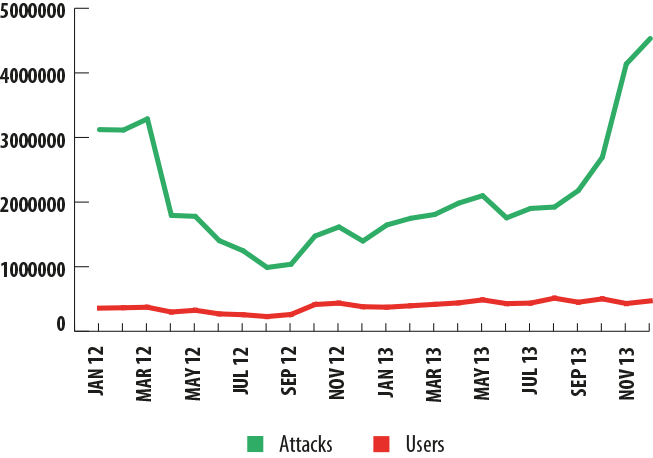

There is a weak correlation between the number of attacks and the number of users targeted. In 2012-2013, the monthly number of attacks varied by tenths of percentages. In spring 2012, it dropped sharply and did not climb back up to its previous position until autumn 2013, although the number of users attacked did not undergo any significant fluctuations and more or less continued to grow on a monthly basis.

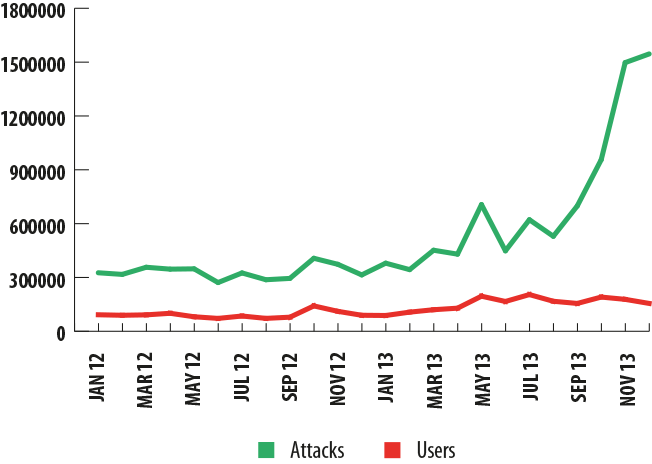

Financial malware: attacks and attacked users in 2012-2013

The number of users targeted in attacks involving financial malware increased over 2013.

The drop in the number of attacks observed in spring 2012 might be linked to the shutdown of several cybercriminal groups. In turn, the surge in attacks seen in the last six months of 2013 can be explained by several factors: malicious users discovered new vulnerabilities in Oracle Java, which made it possible for them to launch more attacks. Furthermore, following a rise in the Bitcoin exchange rate near the end of the year, we saw more programs designed to steal the crypto-currency from user e-wallets.

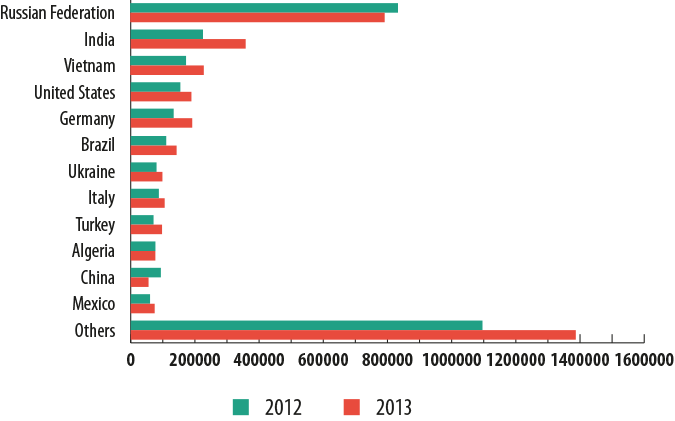

Threat borders: geography of attacks and attacked users

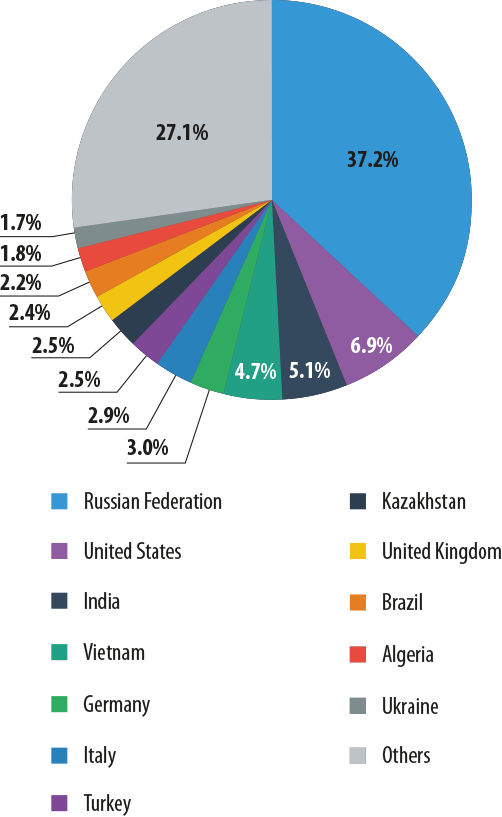

The country most frequently targeted by financial malware in 2012-2013 was Russia, with over 37% of all attacks. No other country had a percentage exceeding 10% over the reporting period.

Most frequently targeted countries in 2012-2013

The Top 10 most frequently attacked countries were on the receiving end of 70% of all financial malware attacks over the past two years.

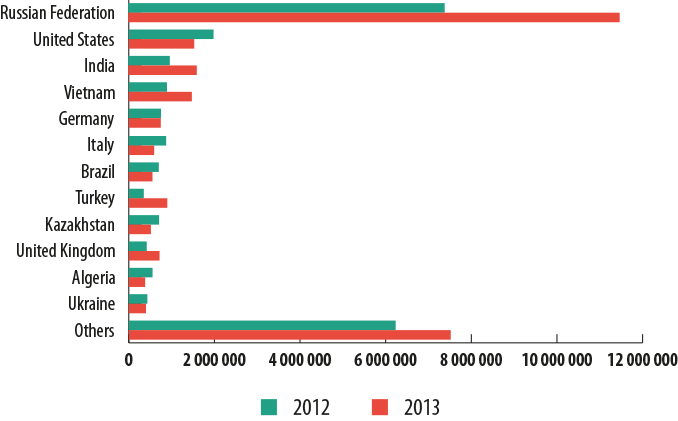

Russia was also the top country when it came to the number of attacks in one year. While the number of users targeted in Russia fell only slightly in 2013, most other countries in the Top 10 saw that number rise.

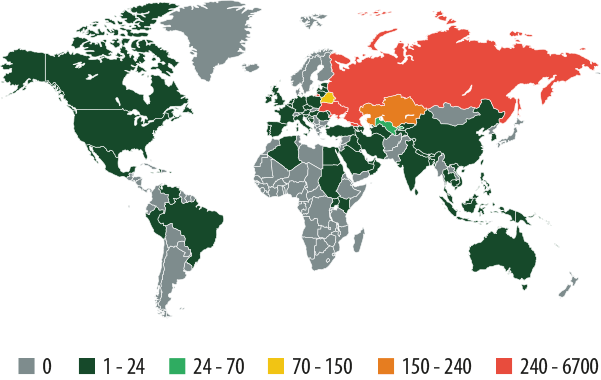

Financial malware attacks around the world

Users targeted by financial malware, by country

The number of users attacked by financial malware over one year increased in eight out of the Top 10 most frequently targeted countries.

Users in Russia faced the highest risk of becoming a victim of financial malware: in 2013, each individual targeted by cybercriminals specializing in financial malware was attacked 14.5 times on average compare that to the average of just over eight times per year for residents of the United States.

| Country | Number of attacks involving financial malware | Year-on-year change | Average number of attacks per user |

| Russian Federation | 11,474,000+ | 55.28% | 14.47 |

| Turkey | 899,000+ | 156.41% | 9.22 |

| United States | 1,529,000+ | -22.76% | 8.08 |

| Vietnam | 1,473,000+ | 65.08% | 6.43 |

| Kazakhstan | 517,000+ | -26.88% | 6.15 |

| Italy | 593,000+ | -32.05% | 5.61 |

| India | 1,600,000+ | 65.03% | 4.47 |

| Ukraine | 401,000+ | -7.54% | 4.07 |

| Germany | 747,000+ | -0.73% | 3.9 |

| Brazil | 553,000+ | -21.02% | 3.87 |

The average number of attacks per resident targeted by financial malware in 2013

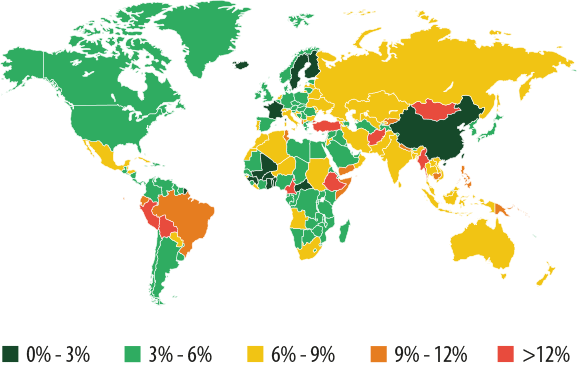

The Top 10 list of countries targeted by online financial threats was led by Turkey and Brazil. The percentage of users subjected to financial attacks in these countries was 12% and 10.5% respectively of the total number of users who encountered malicious programs in 2013. In Russia, that number was slightly over 6%, while just one in every 30 of the total number of users attacked in the US faced a specifically financial cyber threat.

| Country | Users attacked by financial malware | Year-on-year change | % of users attacked by any type of malware |

| Turkey | 97,000+ | 37.05% | 12.01% |

| Brazil | 143,000+ | 29.28% | 10.48% |

| Kazakhstan | 84,000+ | 5.11% | 8.46% |

| Italy | 105,000+ | 20.49% | 8.39% |

| Vietnam | 229,000+ | 31.77% | 7.4% |

| India | 358,000+ | 59.1% | 6.79% |

| Russian Federation | 792,000+ | -4.99% | 6.16% |

| Ukraine | 98,000+ | 22.73% | 6.08% |

| Germany | 191,000+ | 43.22% | 5.52% |

| United States | 189,000+ | 22.30% | 3.1% |

Users attacked by financial malware in 2013 and their respective percentages of the residents of countries who were targeted by any type of malicious program.

If you look at a map of the world, it is clear that the percentages of financial attacks are relatively low in China, the US, Canada, and a number of European countries. The top countries in this category are located all around the world, and some of the most distinctive are Mongolia, Cameroon, Turkey, and Peru.

Percentage of users who encountered financial malware among the total number of users attacked by malware in 2013

Know your enemy: financial malware species

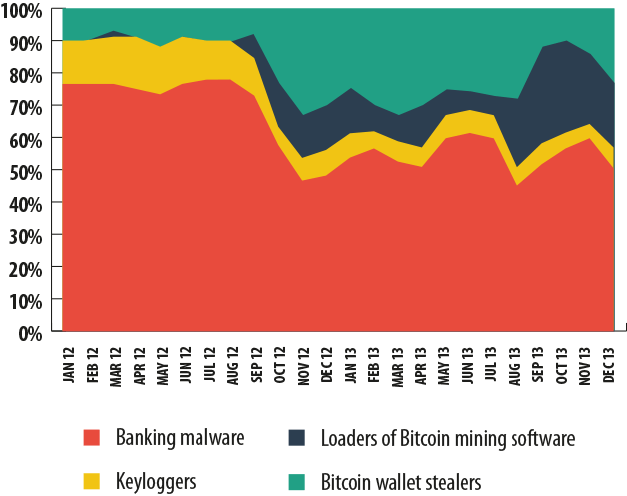

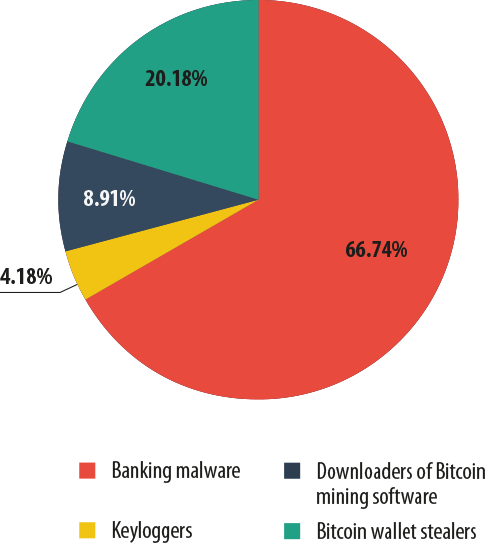

In order to understand which malicious programs target users’ financial assets and made up the landscape of threats over the past year, Kaspersky Lab experts put the tools used by cybercriminals into different categories. For the purposes of this study, the 30 most prevalent examples of malware used in financial attacks were examined. These were further divided into four groups, depending on a program’s function and intended targets: banking malware, keyloggers, Bitcoin theft malware, and Bitcoin crypto-currency software installers.

The most diverse group of programs is the banking malware group, which includes Trojans and backdoors designed to steal cash from online accounts or to harvest data needed to steal cash. Some of the better known programs in this group are Zbot, Carberp, and SpyEye.

Attacks utilizing financial malware in 2013

Programs in the second category – keyloggers – are designed to steal confidential information, including financial data. Often, banking Trojans perform the same function, which can contribute to a decrease in the use of keyloggers as standalone tools. The most well-known among these areKeyLogger and Ardamax.

The last two malware groups are associated with the crypto-currency Bitcoin, which has become a sought-after prize for financial fraudsters over the past couple of years. These programs include tools used to steal Bitcoin wallets, and programs that secretly install applications on infected computers to obtain this currency, also known as mining software.

The first category includes malware that steals Bitcoin wallet files which store data about the bitcoins owned by a user. The second is slightly more difficult to define: in order to install the applications to generate Bitcoins (mining apps), one can use just about any kind of malicious program capable of downloading new programs to a computer without the user noticing, which is why for the purposes of this study, only the programs that have been noted in strict association with downloading and launching mining tools have been included.

It should be noted that this categorization is not 100% precise. For example, one and the same keylogger can be used both to harvest financial data and to steal online gaming account information. However, usually malicious programs tend to have a particular ‘specialization’ which defines its primary unlawful use and function, which allows us to associate each program with a particular category of cybercrime — financial crime, in this case.

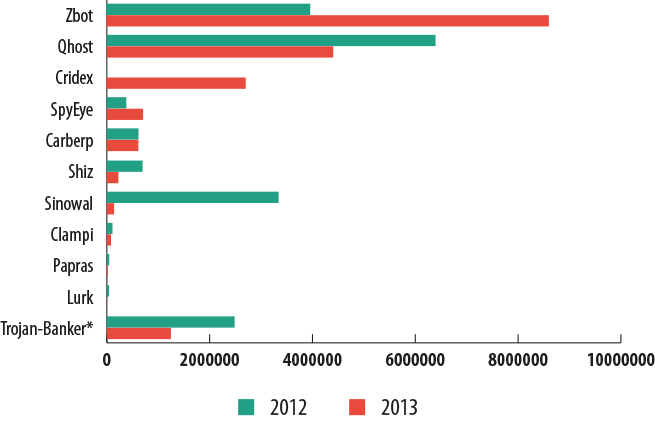

Banking malware strikes

In 2013, banking malware — malicious programs that steal money from user accounts — played a leading role among financial cyber threats. Over the past year, at least 19 million cyber attacks were launched, representing two-thirds of all financial attacks involving malware.

By late 2013, the total percentage of users attacked each month by malicious users aiming to steal Bitcoins and install Bitcoin mining apps almost reached the same level as banking malware.

The most active malicious banking program — both in terms of the number of attacks and in terms of the number of targeted users — is the Trojan Zbot (aka ZeuS). The number of attacks that were traced back to this Trojan’s modifications more than doubled over the course of the year, and the number of users attacked by the Trojan in the past year was greater than all the victims of the other Top 10 malicious banking programs put together.

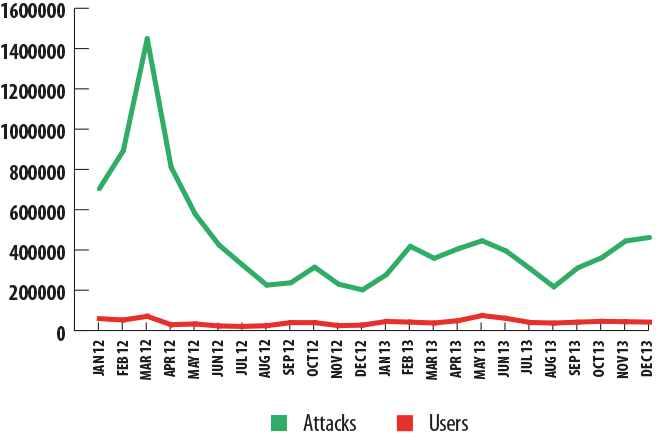

Zbot, 2012-2013

In 2011, Zbot’s source code went public and was used to create (and is still being used to create) new variants of malicious programs, which is impacting attack statistics. Zbot is also known for having served as the foundation for the development of the Citadel platform — one of several attempts to migrate the principles of commercial software into the sphere of malicious program development. Citadel users could not only purchase a Trojan, they could also get tech support and prompt updates to prevent their programs from being detected by antivirus products. Citadel web resources also provided an organized social venue for hackers who could place orders for new functions. In early June 2013, Microsoft collaborated with the FBI and announced the shutdown of several large botnets that had been a part of Citadel; this was a major victory in the war against cybercrime. However, as we can see from Kaspersky Lab statistics, this did not have a huge impact on the proliferation of malicious programs designed to steal financial data.

A sharp drop in the number of attacks using Qhost could potentially be related to the arrest of its creators, who in 2011 stole roughly $400,000 from the clients of one large Russian bank. The program’s creators were sentenced in 2012, yet that did not stop the threat from spreading further. The relative simplicity of its settings and its ease of use means that this program continues to attract new malicious users.

Qhost, 2012-2013

The number of attacks launched using the Carberp Trojan dropped during the first six months of 2013 after the springtime arrest of Trojan users — presumably, these included the program’s creators. However, in summer, the number of Carberp attacks began to rise significantly, bringing 2013’s end-of-year numbers up to the same level as those for 2012. Among other things, this is related to the open-source publication of the malware’s source code, leading to a surge in the development of new versions of the Trojan. All the same, the number of users targeted by these modifications still decreased substantially during the past year.

Carberp, 2012-2013

The general trend is clear: after a bit of a downswing during the last six months of 2012, the scammers responsible for financial cyber attacks in 2013 resumed higher levels of activity as we can see by the increased number of attacks and the higher number of targeted users.

Attacks using banking malware in 2012-2013

* Trojan-Banker is the universal entry in Kaspersky Lab’s database to detect financial malware

Bitcoin: money for nothing?

Bitcoin is an electronic crypto-currency that is not regulated by any government, but is in circulation thanks to its general use. A dedicated network supporting Bitcoin was launched in 2009. It was initially used by people with close ties to the IT industry, but gradually became more widely known. It began to gain popularity as a currency when it became a payment option on several major websites specializing in black market or otherwise illicit trade. These sites chose Bitcoin as it allows users to maintain anonymity.

One variation of a Bitcoin banknote

In theory, anyone who wants to can earn Bitcoins using their computers — this process is called mining. Mining essentially involves solving a series of cryptographic tasks that maintain the Bitcoin network.

Many of those who are considered “Bitcoin-rich” earned their Bitcoin estates back when the crypto-currency was just getting established, and before it was accepted as a liquid cash fund. However, as the currency became more common, it became more difficult to earn Bitcoins through computer performance – this is one of the peculiarities of the system, in addition to the ultimate volume of Bitcoins that will be released into circulation. At this time, the complexity of the requisite computations has increased so much that Bitcoin mining on typical computers has become unprofitable – even potentially loss-making and challenging to just break even when you factor in electricity costs.

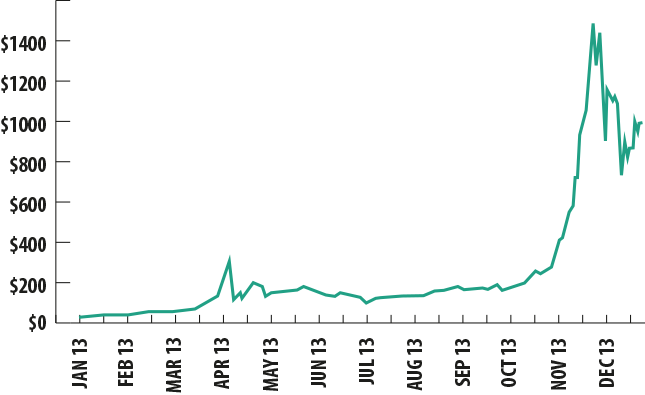

The Bitcoin exchange rate in early 2013 was at $13.60, and by December it had reached a historic high of over $1200.

Over the course of the year, the Bitcoin exchange rate skyrocketed, exceeding $1200 at the close of December. This surge was followed by a decline, including due to the cautious stance among the central banks of a number of countries with regard to this currency. The People’s Bank of China banned the use of Bitcoin exchanges, which cut the currency down by approximately one-third. At the same time, other countries have taken a supportive approach to Bitcoin. In particular, Germany’s Ministry of Finance officially recognized the crypto-currency as a form of payment, and in Canada and the U.S., ATMs are being set up allowing Bitcoins to be transformed into cash funds.

In a word, in just a few years Bitcoin has moved from being a niche Internet phenomenon supported by a small group of enthusiasts to something close to a fully-fledged currency unit that holds actual value and is now hugely sought-after. It makes sense, then, that Bitcoin would naturally draw the attention of malicious users. From the moment that Bitcoin trading was launched on Internet exchanges for real money, more and more sellers began to accept this currency as payment, and cybercriminals became more interested.

Bitcoin is stored on computers in a special wallet file (wallet.dat, or something similar, depending on the app used). If that file is not encrypted and malicious users are able to steal it, then they could transfer all of the funds held therein to their own wallets. The Bitcoin network allows any participant to gain access to the transaction history for any user — that means it’s possible to identify the wallet(s) to which stolen funds were transferred.

In addition to Bitcoin thefts, cybercriminals can also use their victims’ computers to mine Bitcoins, in the same way that they use their victims’ computers to send out spam and perform other malicious operations. There are also well known blackmailer programs that demand a ransom paid in Bitcoin in exchange for deciphering user data.

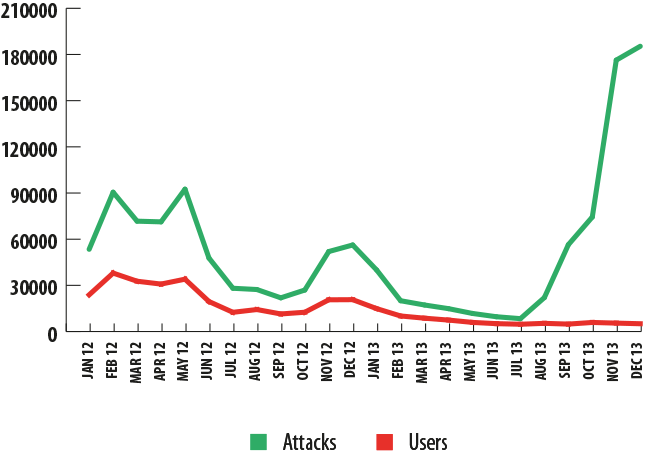

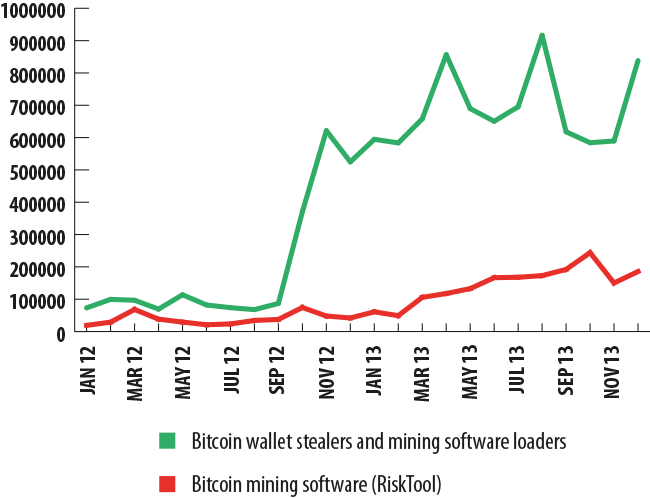

The chart below shows the dynamics of attacks using malicious tools designed to steal Bitcoin wallets, as well as malware that can load mining software on victim computers. In addition, there have also been instances where Bitcoin mining software was detected on a computer and where the owner of the computer could have intentionally installed that software, or it could have gotten on the user’s computer without him knowing. Kaspersky Lab products put these apps into the RiskTool category — that means that this type of app could potentially harbor a malicious function and the user is notified of such.

As you can see from the chart, the number of Kaspersky Lab product detections of Bitcoin theft programs and Bitcoin mining loaders began to rise during the second half of 2012. The dynamics became even more interesting in 2013. For example, one of the two most significant peaks of Kaspersky Lab detections related to Bitcoin took place in April — it was approximately at that time when Bitcoin’s exchange jumped up to over $230. Clearly, the surge in the exchange rate provoked malicious users to more actively spread malware designed to steal or mine Bitcoins.

Incidentally, in April, the currency’s price plunged down to $83. This crash was followed by a recovery up to $149 in late April and stabilization in May. From May until August, Bitcoin held up within a range of $90-100, and in August it began a steady upward surge. This process was only weakly correlated with the situation on the malicious front, although it is possible that it was the stabilization of the Bitcoin exchange rate that essentially provoked a new rush of attacks in August. Another sharp jump in the number of attacks took place in December, when the Bitcoin exchange rate first plummeted from $1,000 down to $584, and then later soared back up to $804 by the end of the month.

Since April, the number of Kaspersky Lab product detections of software used to generate Bitcoin has increased steadily. This growth continued right up through to October, until the number of detections began to decline in November.

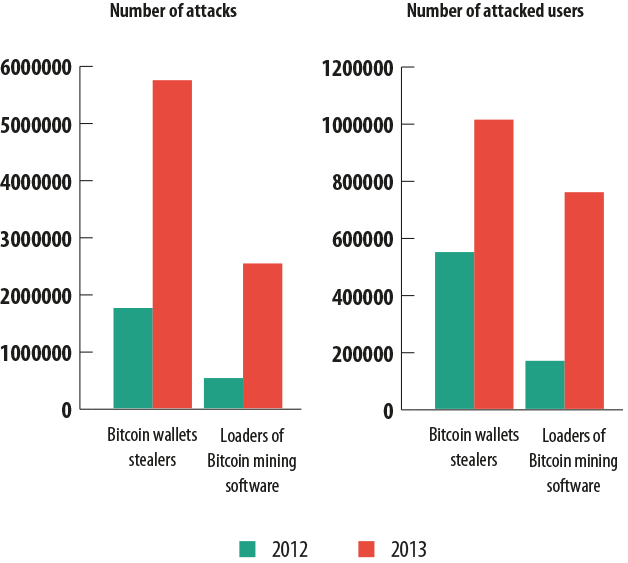

Overall in 2013, both the number of detections registered by Kaspersky Lab products and the number of users coming into contact with malicious or potentially malicious software related to Bitcoin rose dramatically in comparison with 2012. It is also remarkable that starting roughly in October 2013, the number of detections of malicious programs loading Bitcoin mining apps began to drop while, in contrast, the number of detections of Bitcoin wallet theft apps began to rise. This could be the result of the above-mentioned idiosyncrasy of the Bitcoin system, where the more ‘coins’ that are generated, the more difficult it is to generate new ones. This could also drive malicious users to focus on searching for and stealing Bitcoin wallets holding already-generated crypto-currency.

Malicious programs designed to steal financial data are, of course, one of the most dangerous types of cyber threats today. The scale of the threat continues to expand, so we see an enormous amount of potential victims of attacks involving these types of malicious programs — just about everyone who owns a bank card and accesses the Internet from a computer with weak security could fall victim to cybercriminals. However, computers and notebooks are far from the only devices used to conduct financial transactions. Just about every modern individual owns a smartphone or a tablet these days, and for malicious users, these mobile devices offer yet another way to sneak into the pockets of people who use online financial services.

Mobile banking threats

For a long time mobile devices were untouched by cybercriminals. To a large extent this was because the first generations of mobile devices had limited functionality and writing software for them was difficult. However, everything changed with the arrival of smartphones and tablets — versatile devices with Internet connectivity and publicly accessible application development tools. For several years now Kaspersky Lab experts have been recording an annual increase in the number of malicious programs targeting mobile devices, particularly those running Android.

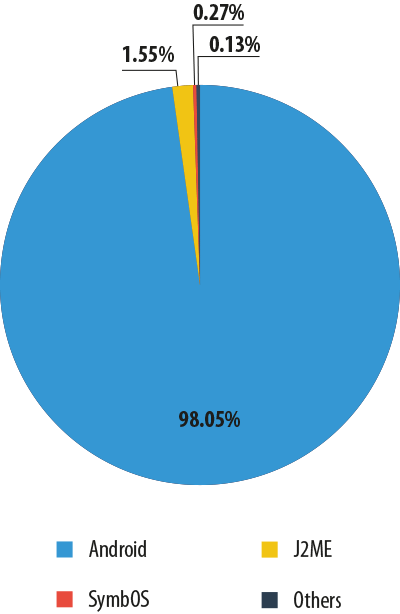

In 2013, Android was the main target for malicious attacks, with 98.1% of all mobile malware detected in 2013 targeting this platform. This is an indication of both the operating system’s popularity and the vulnerability of its architecture.

Mobile malware in 2013

Most malicious programs for mobile devices, including many backdoors and some malware in the Trojan category, are designed to steal money from users. But one of 2013’s most dangerous trends in mobile malware was the growing number of programs designed to steal online banking credentials in order to gain access to people’s money.

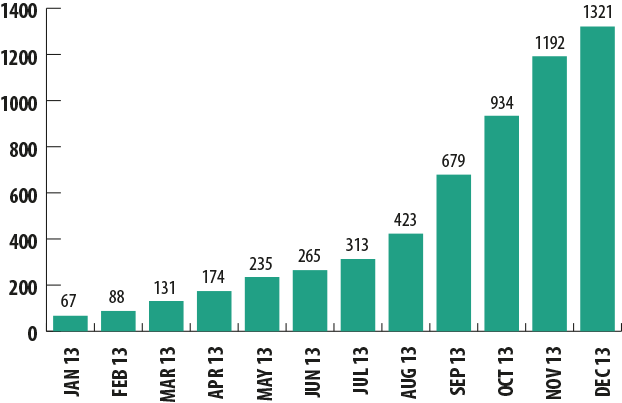

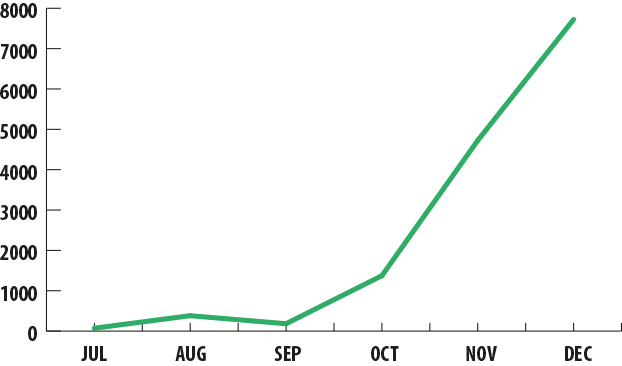

Number of mobile banking malware samples in Kaspersky Lab’s collection in 2013

The number of these malicious programs began to grow rapidly in July and exceeded 1,300 unique samples by December. The number of attacks recorded by Kaspersky Lab began to rise at about the same time.

Attacks with mobile banking malware in 2nd half of 2013

Mobile malware targeting online banking customers is nothing new. For example, ZitMo (the mobile ‘twin’ of Zeus, the infamous Win32 banking Trojan) has been on record since 2010, but until lately it was not known to have been used in mass attacks. That was partly due to its limited functionality: ZitMо could only work in conjunction with the ‘desktop’ version of Zeus. The ‘partner’ program intercepts the victim’s online banking credentials, and then it is up to ZitMo to obtain the one-time passwords used in online banking systems to authorize transactions and send them to cybercriminals, who will use the data to steal money from the victims’ bank accounts.

This fraudulent scheme was also used in 2013: by that time the main competitors of Zeus – SpyEye (SpitMo) and Carberp (CitMo) — had also got themselves ‘little brothers’. However, they are not known to have caused a significant number of attacks. The black market for cyberthreats came up with more ‘autonomous’ Trojan programs, which were able to work without ‘desktop’ counterparts.

One example is the Svpeng Trojan, which was discovered by Kaspersky Lab experts in July 2013. The Trojan takes advantage of the way some of the Russian mobile banking systems work to steal money from victims’ bank accounts.

he customers of some large banks in Russia can top up mobile phone accounts by transferring money from their bank cards. It’s all done by text message, sent to a specific number maintained by the bank. Svpeng sends messages to the SMS services of two of these banks. This enables the owner of Svpeng to find out whether any cards issued by these banks are associated with the infected smartphone’s number and to get balance information if an account exists. After this, the cybercriminal can instruct Svpeng to transfer money from the victim’s bank account to the mobile phone account associated with it.

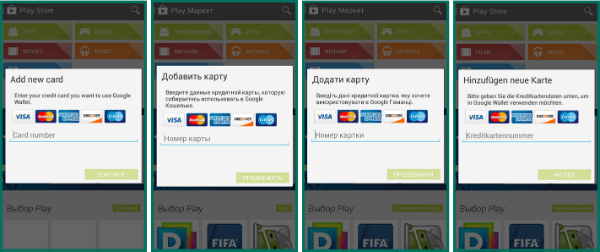

Svpeng fake authorization interface

Money can be subsequently ‘bled’ from the mobile account in different ways – e.g., by transferring it to an online wallet using the user’s account control page on the mobile phone operator’s website or simply by sending messages to premium numbers. Svpeng also has an additional function to steal the user’s online banking credentials.

Two more examples of dangerous banking Trojans discovered by Kaspersky Lab experts are Perkele and Wroba. The former is similar to ZitMo – its main function is to intercept one-time passwords (transaction authorization numbers). The latter searches infected mobile devices for online banking applications and removes any applications found, replacing them with fake copies, which are then used to collect the user’s credentials and send them to the cybercriminals.

Although most of the attacks involving mobile banking Trojans that were detected by Kaspersky Lab took place within the territory of Russia and neighboring countries, Perkele targeted users of some European banks and Wroba targeted users from South Korea.

Geographical distribution of attacks involving malicious mobile banking applications for Android in 2013

In absolute terms, the number of attacks that were detected by Kaspersky Lab products, involved financial malware and targeted mobile users has been relatively low up to now, but their number has been rising – a clear trend which has now been observed for more than six months. It means that users of mobile devices, particularly those running the Android platform, should be extremely careful when it comes to the security of their financial data.

Users of iOS-based devices should not be complacent, either. Although there has not so far been a spate of malware designed to steal sensitive data from iPhone and iPad owners, operating system errors making such malware possible keep appearing. One very recent example is an error found by researchers in late February 2014, which can enable attackers to record the characters entered by the user on the device’s on-screen keyboard. Cybercriminals could take advantage of the vulnerability to steal the user’s online banking credentials, among other sensitive data.

Conclusion: watch your digital wallet

The study has clearly demonstrated that users’ electronic money is under constant threat. Whenever users work with their accounts via online banking or pay for their purchases in online stores, cybercriminals are there hunting for their money.

All types of financial threats demonstrated a significant growth in 2013. The proportion of phishing attacks involving bank brands doubled and that of malware-based financial attacks was a third greater than the year before.

There were no ‘newcomers’ in the financial malware segment which could have an impact comparable to that of Zbot and Qhost. Those two and other infamous Trojans were responsible for the majority of attacks during the past year. However, cybercriminals have once again demonstrated that they are keen to follow any changes in market conditions: the dramatic growth in attacks designed to steal Bitcoins, which began in late 2012, continued in 2013.

Kaspersky Lab experts offer the following advice on enhancing protection against financial cyberthreats.

For business

- Business bears a significant part of the responsibility for users’ security. Financial companies should tell users about the threats posed by cybercriminals and provide advice on the ways to avoid losing money to cyber attacks.

- Banks and payment systems should offer their customers comprehensive protection against cybercriminals. One solution that can be used for this is the Kaspersky Fraud Prevention platform, which offers multi-tier protection against fraud.

For home users and online banking users

- Malware writers often rely on vulnerabilities in popular software. This is why only the latest versions of applications should be used and operating system updates should be installed as soon as they come out.

- Observing universal online security rules helps to minimize the risk associated with financial attacks. Users should choose strong passwords that are unique for each service, be careful when using public Wi-Fi networks, avoid saving sensitive information in the browser, etc.

- It is essential to use reliable anti-malware products that have demonstrated their effectiveness in independent tests. In addition, some security products, such as Kaspersky Internet Security, have built-in tools enabling users to work with online financial services securely.

- If you use a smartphone or tablet to access online banking, a payment system or for online shopping, be sure to protect the device with a reliable security solution, such as Kaspersky Internet Security for Android, which includes advanced tools providing protection against malware, phishing and device loss or theft.

For crypto-currency holders

Since Bitcoin and other similar crypto-currencies, such as Litecoin, Dogecoin and many others, have not been around for very long, many users are unfamiliar with the finer aspects of working with such systems, which is why Kaspersky Lab experts have prepared advice on using crypto-currencies securely:

- Avoid using online services to store your savings; use dedicated wallet applications instead.

- Break up your savings into several wallets — this will help to minimize losses in the event that one of the wallets is stolen.

- Store the wallets where you hold your long-term savings on encrypted media. Alternatively, you can use wallets printed on paper.

Financial cyber threats in 2013. Part 2: malware

Harold Chanin

Is there somebody in the lab with whom I can discuss the U.S. cyber technology which stops “financial malware”?